Defi Articles

DeFi is changing the way we think about money, investments, and financial systems. In this category, we break down everything from yield farming and staking to lending protocols and decentralized exchanges. Whether you're just getting started or you're already deep into the DeFi space, these articles are here to help you navigate this fast-evolving world, understand the opportunities, and stay ahead of the curve.

Read a total of 64 articles and 862 news on Polkadot DeFi written by our community creators

Velocity Labs DeFi Builders Program

This Post, a Konkani (Native India) video, and a TODD news report explains what Velocity Labs is, the 5 Teams selected for Cohort 1 and how these teams can bring to reality Velocity's Aim not just in Polkadot DeFi but Web3 DeFi (Taken step by step; Sigilsafe tomorrow) https://x.com/Inic1234/status/1993620176403615918?t=xxJdxOUbdrXnfQPUmrmCLA&s=19

How I Put My DOT & MYTH to Work with Hydration

Instead of letting my tokens sit idle, I tried liquidity provision on Hydration. It was easier than I expected, and now my DOT/MYTH is earning through fees + treasury rewards. https://x.com/IdokoMj44770/status/1969481222775615799?t=aX06OqaKjiQ7ZHJ9TtqSJA&s=19

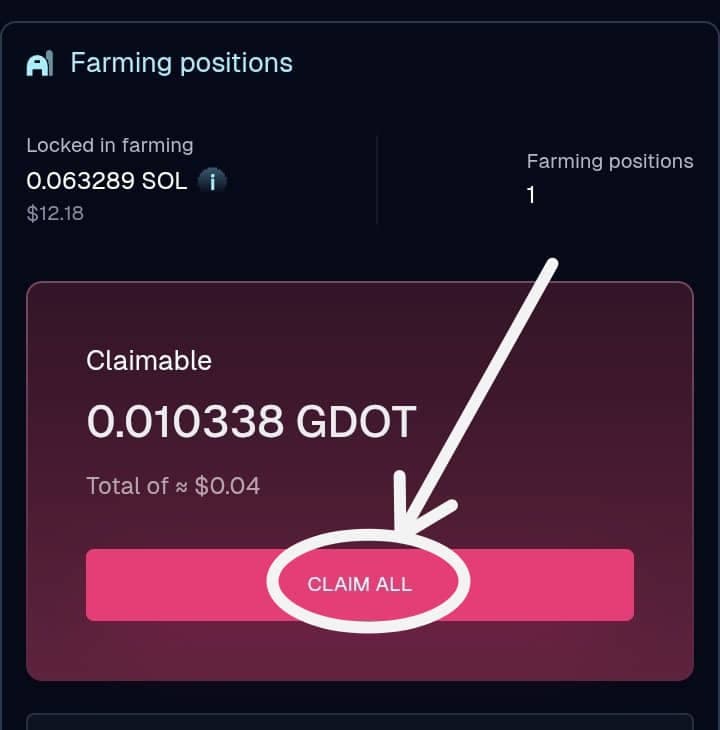

🌐 How I Earned 16% APR in Giga DOT on Hydration’s SOL Farm

Hydration makes DeFi on Polkadot simple and rewarding. In this walkthrough, I’ll show you how to provide liquidity, collect Giga DOT rewards, and keep full control of your funds with no lock-in limits. https://x.com/ChristoDGreat/status/1966972407358648630?t=PgNTv-LxdWVecWyDegBe-A&s=19

波卡“变天”?DOT通胀终结计划:总量上限、类比特币减半机制、生态最新进展全面解读! Hydration, Astar, Bifrost, Acala等等

this video mainly talk about the influence of opengov proposal 1710, and then go over several main eco project like hydration astar bifrost unique acala, and talking about the potential of Polkadot in my opinion: ETF approval and stable coin like Hollar and others, finally with an open question with audience Link:

LV 5

this week we made DeFi. step by step, hydration HQ finance lv corporation operations, full GDOT fresh flow compounding. lets hit the 3 digits thes week innit uh :-) Links: - https://x.com/LVweb3/status/1963006872417698096 - https://x.com/LVweb3/status/1963912146154320345 - https://x.com/LVweb3/status/1963366433737642057 - https://x.com/LVweb3/status/1962610738058666131

Defi News

Send the BEEFY Back, They Wanted it Well Done

After transitioning to parathread status with on-demand Coretime, the Hyperbridge system triggered an emergency pause. This is because the Polkadot SDK currently lacks BEEFY consensus support for parathreads, which is essential for proof generation. An update is underway and will be Whitelisted on OpenGov shortly.

Bifrost’s Horsing Around for the New Year

The Lunar New Year is almost here, and to celebrate, Bifrost is giving away 30K BNC to the community from February 11th to 17th. To enter the draw, like, repost, and comment on the official tweet, then verify your participation in the bifrost-quest Discord channel.

Hydrated Strategy Flows Into Action

The talking phase is over. Hydration’s new Hydrated Strategy, focused on credit provision, real-world yield, and predictable revenue, is now being deployed. It directs capital into stable funds, real-economy lending, and tokenized mortgages to deliver consistent returns for the protocol and its users, regardless of market cycles.

DeFi

DeFi